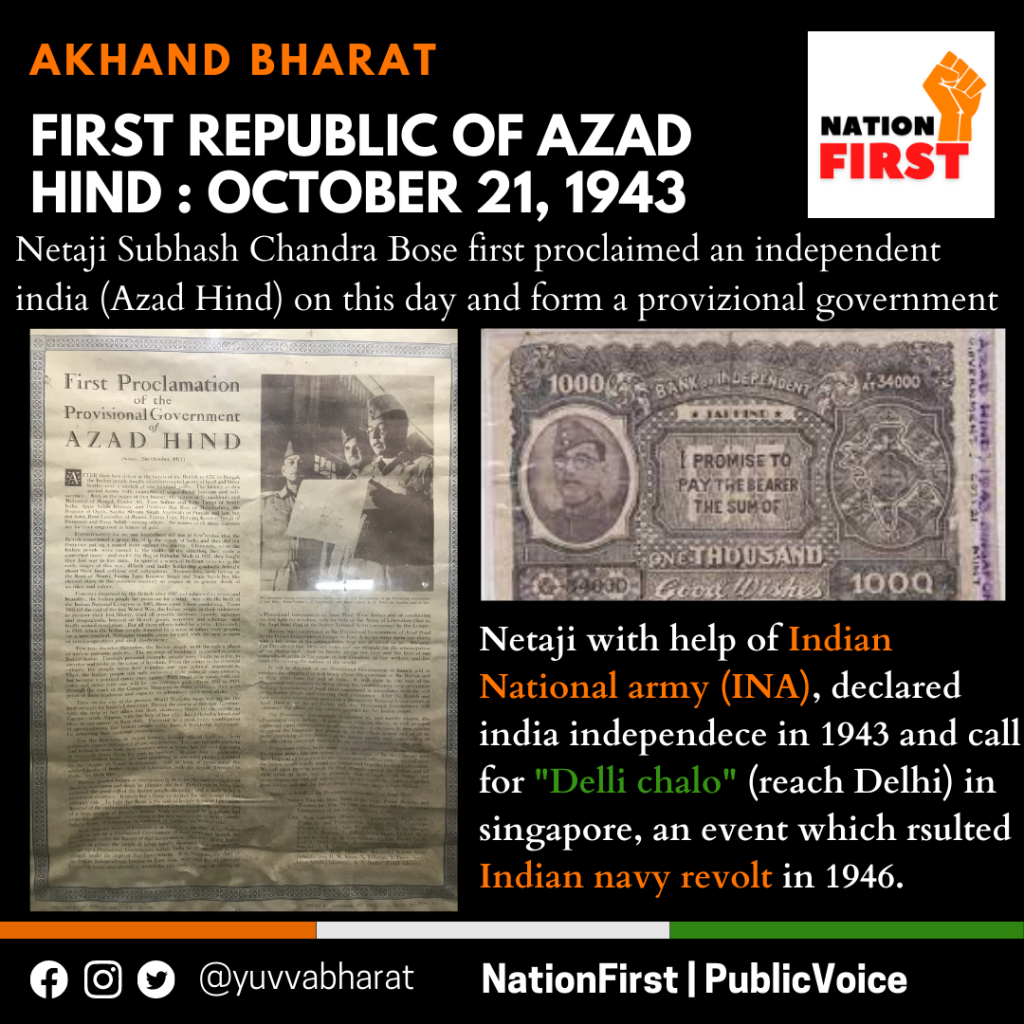

Hey there! Have you heard about the power of personal finance? It’s all about managing your money and making smart financial decisions that can positively influence your life. Even though it’s essential, we know that many people find finances overwhelming and can face common challenges. But don’t worry, I’m here to help! In this blog, I’ve compiled 10 personal finance tips that are super easy to understand and can transform your money management skills. By implementing these tips, you can set yourself up for financial success and live the life you dream of. Let’s dive in!

One step at a time !

Personal Finance

Why personal finance is important ?

Managing your personal finances can open doors you never thought were possible. With effective finance management, you can achieve your life goals and experience financial freedom, completely stress-free. It’s never too late to start and you won’t believe the peace of mind that comes with it. Take the first step today, let’s begin this journey together and watch your financial stability soar to new heights. The power to control your finances and create the life you desire is in your hands. Let’s do this!

Common financial challenges people face

Financial difficulties are a widespread issue that many people encounter, such as debt, overspending, inadequate savings, and lack of financial knowledge. These challenges can impede people’s ability to manage their finances successfully, thereby making it challenging to achieve financial prosperity.

“Most people fail to realize that in life, it’s not how much money you make. It’s how much money you keep … Money without financial intelligence is money soon gone”

- Robert Kiyosaki

From Book: Rich Dad Poor Dad

Let’s explore the practical and actionable personal finance tips that can transform your money management skills.

1. Create a budget

Importance of budgeting

Making a budget is a helpful tool for tracking where your money goes, prioritizing expenses, and making sound financial decisions. With a budget, you can take control of your spending and ensure that your hard-earned money is going where it should. So why not start today and watch your finances flourish!

Simple steps to create a budget

- Calculate your income

- List all your expenses

- Categorize your expenses

- Allocate funds to each category

- Refine your budget as needed

Tips for sticking to your budget

- Track your spending regularly

- Set realistic goals

- Eliminate unnecessary expenses

- Use cash instead of credit cards

2. Track your spending

Why tracking your spending is crucial ?

Keeping track of your spending is a great way to get a handle on your finances. By tracking your expenses, you’ll be able to identify any habits that might be holding you back and make changes to help you reach your financial goals. Plus, it’s a handy tool for making sure you’re staying within your budget and putting your money where it really counts. So why not give it a try? You might be surprised at how much you can learn about yourself – not to mention how much money you can save!

How to track your spending ?

- Use a mobile app or online tool

- Use a spreadsheet

- Keep receipts and record manually

Tools to use for tracking spending

Mint

Personal Capital

YNAB

3. Reduce expenses

Why reducing expenses is important ?

Cutting down on expenses can be a great way to save some extra cash for those rainy days or even invest in some future goals you might have. Plus, it can also help you pay off any outstanding debts you may have. So why not give it a try? You might be surprised at how easy it is to save a little bit here and there!

Tips for cutting expenses

- Reduce eating out

- Cancel subscriptions

- Lower utility bills

- Shop for deals

How to identify unnecessary expenses ?

- Review your bank and credit card statements

- Analyze your spending habits

- Cut out non-essential expenses

4. Pay off debt

The consequences of carrying debt

Did you know that carrying around a lot of debt can totally cramp your style? It can make it way harder to achieve your goals and feel financially free. So, here’s a little reminder to shake off that debt and start feeling the financial freedom you deserve! Let’s do this thing, debt-free style!

Strategies for paying off debt

- Snowball method

- Avalanche method

- Debt consolidation

Choosing the right debt repayment method

- Consider interest rates

- Determine your financial goals

- Understand your cash flow

5. Build an emergency fund

Why having an emergency fund is crucial ?

Did you know that having an emergency fund can really come in handy when unexpected expenses come up? Not only does it give you some breathing room, but it also helps you avoid relying on credit cards. Plus, there’s no denying that having that extra bit of security can really give you some peace of mind during those stressful financial moments. So why not start building your emergency fund today? Your future self will thank you!

How much to save ?

- Aim for 3-6 months of living expenses

- Adjust for personal circumstances

- Investing solely for emergency in Fixed deposits and assets

Tips for building an emergency fund

- Start small

- Automate contributions

- Prioritize building your emergency fund while investing

6. Save for retirement

The importance of saving for retirement

Saving for retirement is an important step to ensure financial stability and enjoy a comfortable retirement. With the right savings plan, individuals can enjoy their golden years stress-free.

Types of retirement accounts

- Government Pension schemes

- Private Pension Schemes

- Retirement Policies

- Mutual Funds

How to determine how much to save

- Estimate retirement expenses

- Calculate retirement income

- Determine the amount to save based on goals

7. Invest your money

Why investing is important

Investing can be a great way for you to build your wealth over time and reach those long-term financial goals that you have in mind. Whether you’re looking to save up for your children’s education or plan for your retirement, investing offers a path towards greater financial security. It can be a little daunting at first, but with a bit of guidance and the right strategy, anyone can become a successful investor. So why not take the first step today and start building towards a brighter financial future?

Types of investments to consider

- Stocks

- Bonds

- Mutual Funds

- Gold

- Real estate

Steps to start investing

- Educate yourself

- Select a brokerage firm

- Develop an investment strategy

- Use Financial Apps

- Seek Financial Advice

8. Understand your credit score

What is a credit score ?

Having a good credit score is of utmost importance for individuals as it determines their ability to secure loans, mortgages, credit cards and other financial products. Credit scores usually range from 300 to 850, with higher scores indicating better creditworthiness and greater chances of loan approval at lower interest rates.

A credit score is not just a number, it is a reflection of how an individual handles their financial responsibilities. Maintaining a good credit score requires consistent and timely payments of bills, regular checking of credit reports for errors, and keeping balances low on credit cards.

In today’s world, a good credit score is vital for accessing financial products and services at favorable rates. Hence, it is recommended that individuals keep a check on their credit score and take necessary steps to improve it if needed.

How to check your credit score ?

- Use a credit monitoring service

- Get a free credit report from each credit bureau annually

- Use any financial assets application

- online free credit checkers

- Contact Your Bank

Tips for improving your credit score

- Pay bills on time

- Keep credit utilization low

- Dispute errors on credit reports

- Use EMI and pay off on time

- Get bank loans and pay interest on time

9. Protect your assets

The importance of asset protection

Did you know that asset protection can help you keep your hard-earned wealth safe and secure? It’s a great way to prevent any unexpected financial losses from taking a toll on you.

Types of insurance to consider

- Life insurance

- Health insurance

- Homeowners/renters insurance

- Auto insurance

How to choose the right insurance ?

- Research options

- Consider personal circumstances

- Review policy terms

- Seek financial advice

10. Build good financial habits

Why habits are important

Creating strong financial habits is an important strategy for realizing personal financial goals and achieving greater overall well-being. By developing sound financial habits, individuals empower themselves to manage their finances with confidence and achieve their long-term objectives. Cultivating effective financial habits requires commitment and discipline, but the payoff is well worth the effort. Through consistent saving, budgeting, and mindful spending, individuals can minimize financial stress and achieve greater financial freedom. Investing time and energy into building strong financial habits is a wise choice, one that can lead to a more secure and fulfilling life.

Examples of good financial habits

- Set financial goals

- Prioritize savings

- Live below your means

- Invest in yourself

How to cultivate good financial habits

- Develop a routine

- Educate yourself

- Surround yourself with likeminded individuals

In conclusion, these 10 personal finance tips can help transform your money management skills and put you on the path towards financial success. By creating a budget, tracking your spending, reducing expenses, paying off debt, building an emergency fund, saving for retirement, investing your money, understanding your credit score, protecting your assets, and building good financial habits, you can achieve your financial goals and create financial stability in your life.

F.A.Q.

Personal Finance Management

The best way to create a budget is to calculate your income, list all your expenses, categorize your expenses, allocate funds to each category, and refine your budget as needed.

When monitoring your spending, you should track all your expenses, including fixed expenses, variable expenses, and discretionary expenses.

The amount you should save for retirement depends on your personal circumstances and retirement goals. However, a general rule of thumb is to aim for 3-6 months of living expenses.

A good credit score is typically considered to be a score above 700.

Yes, insurance is important for everyone, regardless of age or health. Accidents, illnesses, and unexpected events can happen at any time and can have significant financial consequences.

Building good financial habits takes time and effort. However, by developing a routine, educating yourself, and surrounding yourself with likeminded individuals, you can achieve your financial goals and create a lifestyle of financial stability.